Janie Elliott-Dunn, Farnham BID Manager, said: “There’s a lot in this Budget that will be challenging for small businesses and working people. Rising payroll costs and frozen tax thresholds mean many independents may have to work even harder just to stand still, and households may find they have less to spend on their local high street.

“Small businesses are the heart of Farnham - they create jobs, energy and identity for our town. We want to ensure they continue to have the opportunity to grow and thrive.

“At this time, it’s more important than ever that we support local, champion our independents and keep Farnham vibrant and welcoming for residents and visitors alike.”

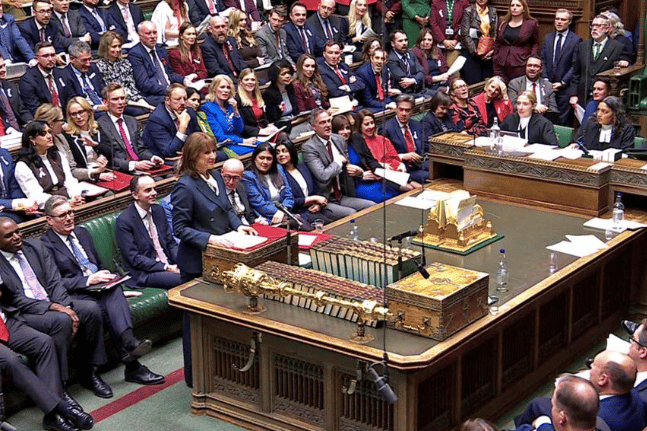

The country had awaited the Chancellor of the Exchequer’s winter budget on Wednesday, November 26, but the wait was cut short when the Office for Budget Responsibility (OBR) leaked key details ahead of Rachel Reeves’ speech at 12.30pm.

The leak emerged as the Prime Minister was answering Prime Minister’s Questions, prompting MPs to check their phones as the announcement broke before the Chancellor reached the dispatch box.

The Government’s winter budget set out plans to increase tax revenue while also revealing the country is behind the OBR’s previous forecasts for growth and productivity.

Rachel Reeves sought to raise money for the Government without breaking her manifesto promises not to increase income tax, corporation tax and VAT. This left her in a difficult financial position, with funding instead expected to be raised through measures including taxes on pensions, electric vehicles and the introduction of a so-called “mansion tax”.

Some of the key changes are as follows:

The annual Individual Savings Account (ISA) cash limit will be set at £12,000, down from £20,000. There will be a £2,000 cap on the amount that can be put into a pension and shielded from national insurance contributions through salary sacrifice from April 2029. The minimum wage for 18 to 20-year-olds will rise from £10 to £10.85. Properties valued at more than £2 million will be hit with a new “mansion tax”, charging between £2,500 and £7,500 a year. Owners of electric vehicles will face a new charge of three pence per mile from April 2028. The two-child benefit cap will be lifted on means-tested benefits.

While the effect of the winter budget on business was not as hard-hitting as the spring budget, firms are still expected to feel the impact of the Chancellor’s tax-raising measures.

The biggest pressure on small independent businesses is expected to come from the knock-on effect of fiscal drag. Rising payroll costs through increasing wages and inflation, alongside frozen tax thresholds until 2031, are likely to push more employees into higher tax brackets. This was acknowledged by the Chancellor as a move that will affect working people.

The measures are expected to generate £42.9 billion by 2027, but economists have warned they could discourage people from working longer hours to earn more or from saving money.

.jpeg?width=209&height=140&crop=209:145,smart&quality=75)

Comments

This article has no comments yet. Be the first to leave a comment.