The figures show that a total of £100 million of premium bond prizes remain unclaimed in England, Wales and Scotland, amid criticism the Government-owned bank is not doing enough to find the winners.

Among the 2.5 million unclaimed prizes are 11 winners of £100,000 - the second-largest prize available.

Critics say the process to trace accounts needs reform as it is too difficult for people gifted them or those who only ever had paper records.

In Hampshire, £2,662,125 remains unclaimed,the largest of which is a £25,000 prize awarded in April 2023.

Meanwhile, in Surrey, unclaimed prizes total £2,490,650, with the most valuable being a £50,000 prize drawn in June 2019.

National Savings and Investments (NS&I), the state-owned bank which operates the scheme, said it had paid more than 99 percent of the prize-winners since starting its tax-free draws in 1957.

Wills and probate solicitor Patrice Lawrence said she had helped seven people trace accounts including clients, and friends and family.

She said it was “shocking that a government-owned bank is sitting on over £100m in unclaimed prizes…[and] how many people are being deprived of some financial respite from the cost of living crisis as a result?”

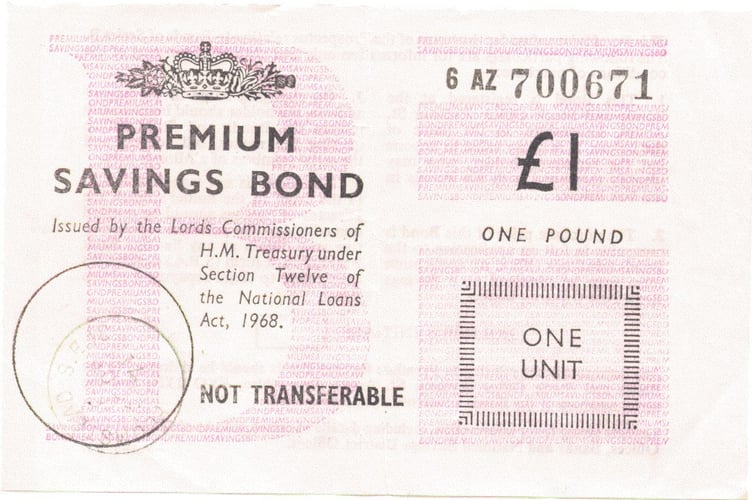

Each month in the UK, premium bonds are entered into a draw that could see holders win £1m, or smaller prizes of descending value down to £25.

NS&I said every jackpot millionaire had received their money.

Since the first draw in June 1957, its Electronic Random Number Indicator Equipment - known as ERNIE - had drawn a total of 772 million prizes worth a combined £37bn.

Premium bonds prize winners should receive notifications of their winnings via text message, email or post if they have registered their details.

Some customers, however, relocate and forget to update their details.

Other bond holdings are not registered. For example, people may be unaware they were gifted bonds as children, or they were never given the paper certificate carrying the account numbers.

NS&I retail director Andrew Westhead said the bank recognised bonds purchased before digitalisation "were much harder to trace".

Nearly 23 million people had Premium Bonds accounts worth a combined £130 billion, as of March 31, 2025.

The oldest unclaimed prize was £25 won in November 1957 in South Yorkshire.

Sam Richardson, deputy editor from the consumer group Which? Money, said NS&I could "make the process smoother" if it joined the Government's Tell Us Once service, or the private equivalent, the Death Notification Service, which were "often overlooked and undersubscribed" schemes aiming to simplify the process of notifying different organisations after a death.

BBC Morning Live's resident money expert Iona Bain said: "Whilst it can be administratively complex to track down historic money, NS&I needs to consider how it can improve this process so it's much less rigid, bureaucratic and, frankly, disappointing."

Comments

This article has no comments yet. Be the first to leave a comment.